Pandemic Pushes Cirque du Soleil Into Bankruptcy

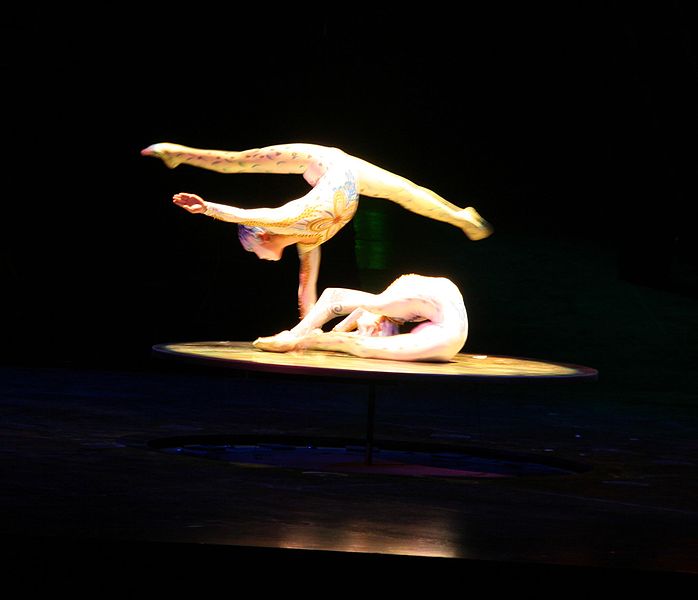

Montreal-based Cirque du Soleil Entertainment filed for protection from creditors in Canada on Monday after the coronavirus pandemic forced it to close shows around the world, triggering a fight for control of one of the best-known brands in live performance.

The company said it entered into a so-called stalking horse agreement with its existing shareholders — including TPG, China’s Fosun International Ltd. and Caisse de Depot et Placement du Quebec — for a $300-million injection to help restart the business.

That proposal would see a restructured Cirque cut its debt to about $250 million, Chief Executive Officer Daniel Lamarre said in an interview. It has nearly $1.6 billion in liabilities.

But creditors are unlikely to accept the terms of the TPG plan that would leave them with a 45% stake in the company in exchange for wiping out most of its debt, according to three people familiar with the matter who were not authorized to comment. A creditor group will likely come back with a formal counteroffer by July 10, one of the people said; it has already drafted its own non-binding offer for Cirque, according to another one of the people.

Entertainment companies that depend on large crowds were among the first business casualties of the virus. Cirque du Soleil laid off 4,679 employees — about 95% of its workforce — on March 19 after shutting down 44 productions to comply with government orders around the world. It has only one active show right now, in China, Lamarre said.

The crisis hit the 36-year-old company just as it emerged from a string of acquisitions, which helped it diversify from its original acrobatic shows but also put it deeper into debt.

It bought Blue Man Productions in 2017, followed by children’s entertainment company VStar Entertainment Group in 2018. Last year, it added Works Entertainment and its troupe of magicians called the Illusionists to its portfolio before striking a separate deal to make feature-length films with the company that co-produced the hit “The Lego Movie.”

Cirque expects to emerge from the restructuring process as a leaner entity with about 1,000 employees initially. About 700 of them would be in Las Vegas, where the company earned around 40% of its $1 billion in revenue last year and where it hopes to open a show as early as November, Lamarre said. Touring shows could come back in 2021 if the virus situation allows for it, he said.

Cirque requested protection through the companies’ Creditors Arrangement Act on Monday afternoon. The application is scheduled to be heard by the Quebec Superior Court on Tuesday, and the company will also seek its immediate provisional recognition in the U.S. under Chapter 15.

The filing starts the clock on a bidding process for control of a restructured Cirque. Quebecor Inc. and Cirque founder Guy Laliberte have expressed interest in investing in the company.

“We know there are probably five other parties that will be interested to make an offer,” Lamarre said. “The good news today is that we know that someone is committed to ensure the future of the company. And within 45 days, we’ll know if someone is willing to invest even more.”

The Quebec government’s investment and lending arm, Investissement Quebec, is providing $200 million of the $300 million in new capital proposed by the TPG-led group. The group wants to acquire substantially all of the company’s assets for a combination of cash, debt and equity. It says its offer has a total value of $420 million.

Cirque du Soleil’s existing secured creditors would receive $50 million of unsecured, take-back debt in addition to the 45% equity stake, according to the proposal.